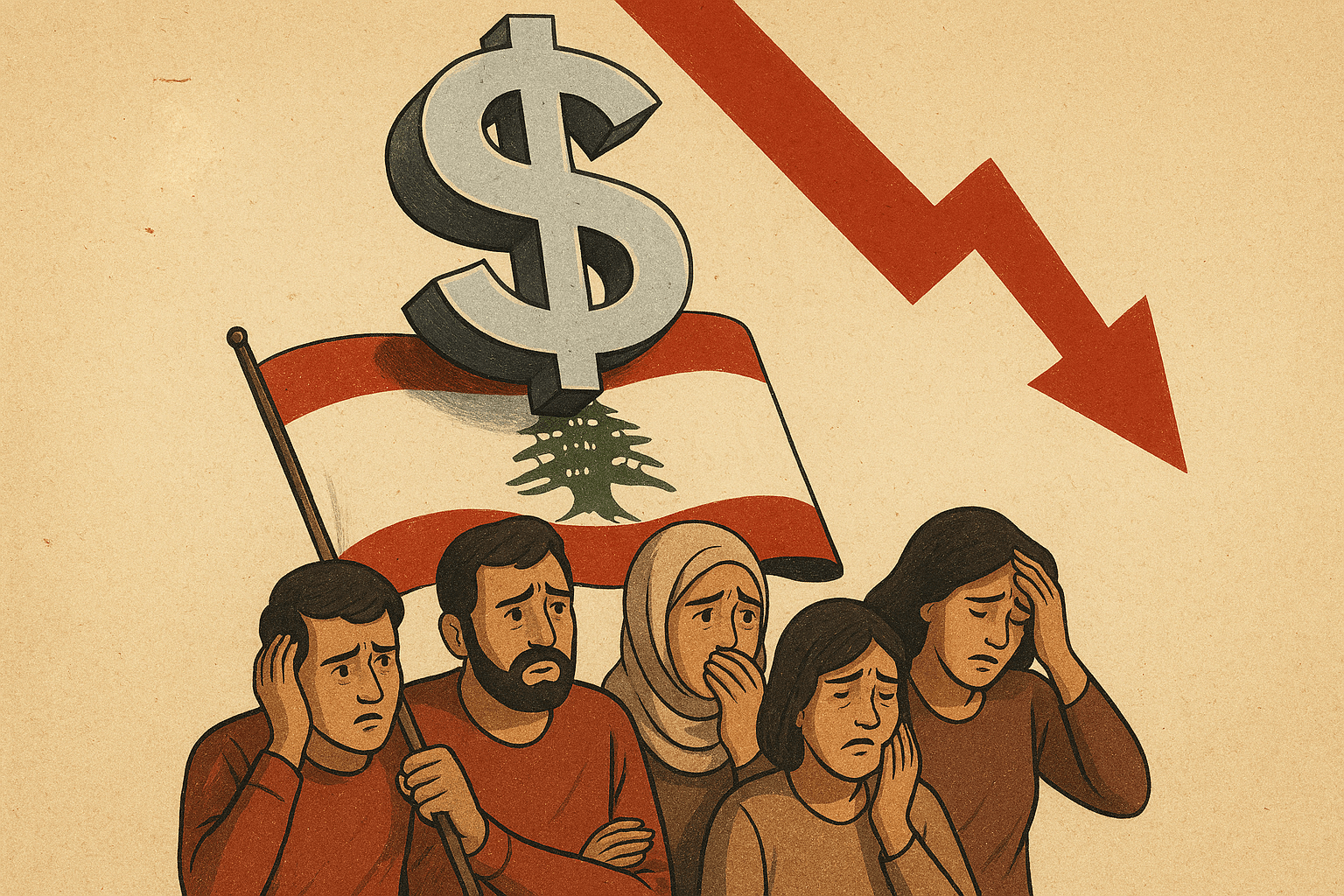

Why is the American interest hurting us in Lebanon?

We often hear the news that the US Central Bank (Federal Reserve) has raised or lowered interest rates. Anyone can ask: "Ok, what happened to us in Lebanon?". But the truth is that these decisions are like dominoes, blurring from Washington and reaching our wonder, because the Lebanese economy, from deposits to cash in dollars to loan prices and even commodity prices, are all directly or indirectly affected by the decisions of the American interest.

1- First of all, we must know that the dollar is the master of the game in Lebanon.Almost everything is tied in: from bank deposits, to debt, to market prices. At a time when the US Federal Reserve raises interest, dollar money becomes the most expensive in the world. I mean, if an investor was a thinker who demeaned Egyptians in emerging markets (including Lebanon), he would prefer to demolish America because the holidays have become sweeter and more secure.

This makes a hemorrhage of capital that can be missed in Lebanon. I mean, the dollar is scarce, and demand for it is increasing, and therefore its price in the Lebanese street can be affected more.

2- Second job, loans.When the benefits of the world are high, naturally any dollar loan becomes more expensive. I mean, companies or individuals in Lebanon are borrowers, they meet under the pressure of increasing the cost, especially if our country has an enemy in an economic coma and there is no growth.

3- Also, the prices of goods do not escape the repercussions of the decisions of the beneficiary, because the dollar plays a key role in importing. If the dollar becomes rarer and more expensive, the cost of imported goods will look forward. I mean, the high prices multiply for people and make living more difficult.

But not all the picture is black, because if the interests in America descend, it becomes in the field of capital revolving on other markets. In this case, the pressure on the dollar in Lebanon can be eased, but the problem is that our internal situation is not encouraging to attract any investment.

Ok, how are Lebanese banks affected by American interest?

Today, banks in Lebanon are almost paralyzed: they do not receive serious deposits like before, nor do they give loans except in rare cases and on complex conditions. This situation is changing a little bit how the effects of the decisions of the American interest reach us.

For Deposits

Since people have lost confidence in banks and do not keep dollars in cash (under the pillow or in foreign remittances), the impact of the rise or fall of US interest becomes more "psychological" than practical. I mean, the Lebanese depositor no longer runs to the bank to benefit from the benefit, because he knows that there is no free access to the deposits.

For lending

Banks do not give loans, and if they give, they are either small loans or in dollars "fresh" and with interest on fire. In this case, if the benefits rise in America, the difference is more symbolic: banks have an argument saying that "global conditions are difficult," but in fact they are not even financing the economy.

Practical effect

The biggest impact is on the state and companies that have debts or obligations in dollars. Any increase in benefits globally is an additional decrease for them. As for the banks, they are already standing like a stone, and they live on minimum operations (transfers or receiving pensions or basic services).

Conclusion, Lebanese

When you hear the news that the US Federal Reserve has raised or lowered the interest rate, think that this decision is not far from your pocket. From the price of the dollar, to interest on loans, to the prices of foodstuffs. Solution? An organized, capable country that creates trust and protects the currency. But as long as there is no repair, we will continue to receive shocks from the ground and push them out of our pocket.

Also, the impact of American interests today is not through banks directly, because they are almost closed, but through the price of the dollar in the market, the cost of import and the pressure of foreign debt. The depositor or the ordinary citizen does not feel a change in the interest rates of his account in the bank, because they simply counted and did not move.