Arab Golden Cities: Where to invest your property today to achieve the highest return?

In a rapidly changing world, real estate remains a safe haven for investors aspiring to sustainable returns and real capital growth. As eyes turn to the Middle East, major Arab cities such as Dubai, Riyadh, New Cairo, Doha, Muscat, Amman, and Beirut are emerging as unparalleled investment destinations, combining economic stability, urban development, and promising opportunities in various real estate sectors.

Whether you're looking for a long-term investment in luxury residential projects, or want to seize the opportunities of rapid growth in emerging markets, these cities offer you a unique combination of high yield, diversity, and a supportive legislative environment. In this report, we take you on an analytical tour through the most prominent real estate markets in the Middle East, to reveal the secrets of success and the most important tips to make the most of your investments in the heart of vibrant Arab cities.

Dubai – United Arab Emirates

Dubai tops the list of the best cities for real estate investment in the region, thanks to its advanced infrastructure, attractive laws for investors such as golden residency, and global business environment. Dubai is experiencing a rebound in demand for luxury residential properties and villas, especially in areas such as Downtown Dubai, along with commercial properties in the Dubai International Financial Centre, and coastal tourism properties. Demand and return on investment are expected to continue to rise in 2025, supported by mega-projects such as Dubai Future City.

Riyadh, Kingdom of Saudi Arabia

Riyadh is the economic heart of the Kingdom and is witnessing a massive urban expansion within Vision 2030, with major projects such as NEOM, Qiddiya and the Red Sea City. There is a growing demand for luxury residential units in new neighbourhoods, as well as significant opportunities in commercial real estate and business centres. Riyadh is an ideal choice for long-term investment, especially with high purchasing power and increasing population.

New Cairo, Egypt

New Cairo and the New Administrative Capital are Egypt's largest real estate market, with exponential growth in the construction and development sector. There are significant investment opportunities in modern suburban apartments, commercial projects such as shopping malls and offices, as well as tourist properties in areas such as the North Coast and Ras al-Hikma. The Egyptian market is witnessing a great economic opening and expectations of increasing supply and demand.

Doha, Qatar

Doha is characterized by economic stability and sustainable growth, especially after hosting the World Cup 2022. There is a high demand for luxury residential properties in areas such as Lusail Bay, as well as commercial projects and hotels, supported by a growing tourism sector. The Qatari market remains attractive to domestic and foreign investors.

Muscat Sultanate of Oman

Muscat is experiencing political and economic stability, and seeks to develop the tourism and real estate investment sector. There are promising opportunities in modern residential properties, hotels and resorts, especially with infrastructure and public utility development projects.

AMMAN JO

Amman is one of the most attractive cities for real estate investment in the region, thanks to its relative stability and high demand for residential and commercial real estate. The city offers good opportunities for investors looking for stable rental returns.

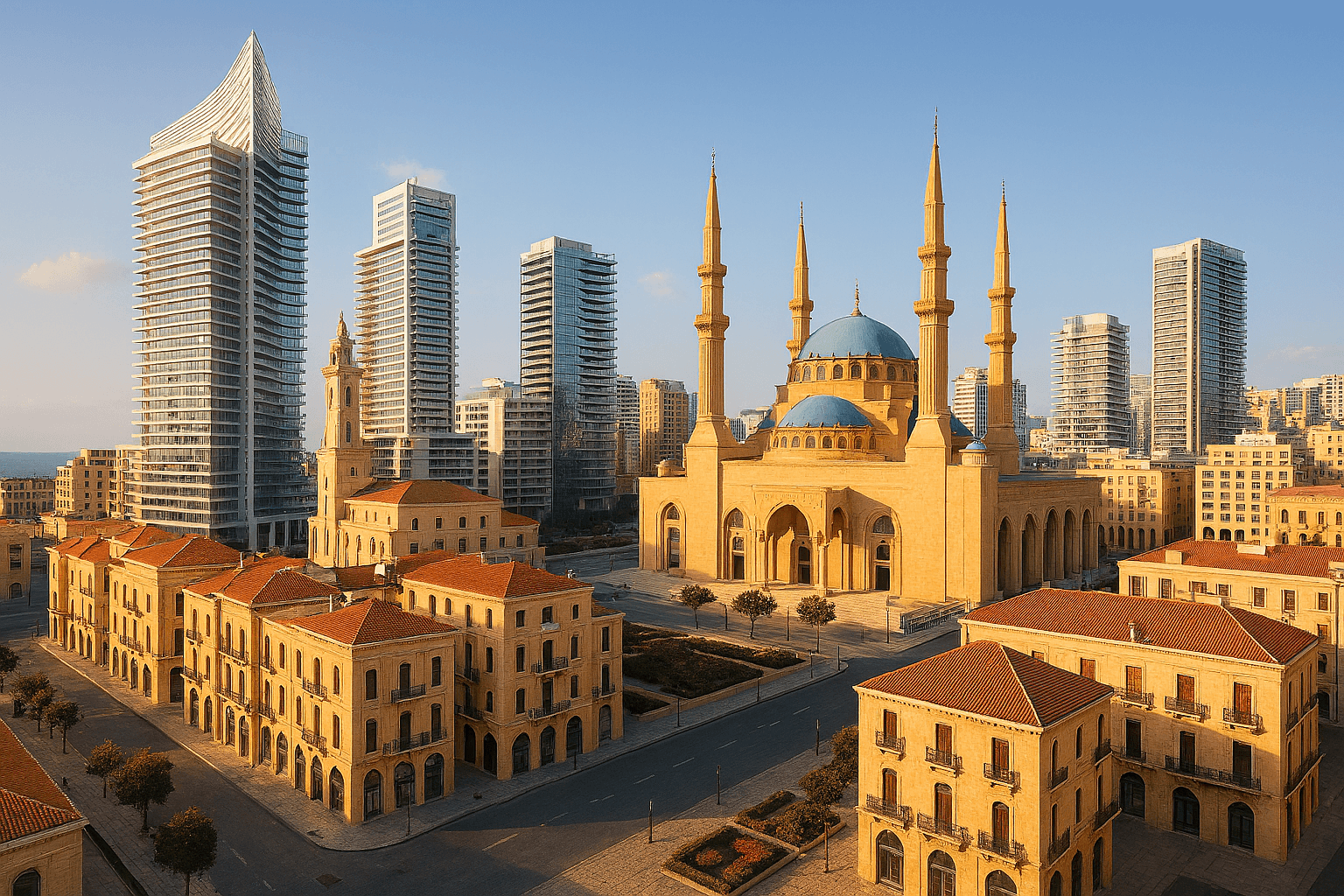

Beirut - Lebanon

Despite economic challenges, Beirut remains a major investment hub, especially in luxury residential properties in areas such as Ashrafieh, and commercial properties in the city center. The Lebanese market may present opportunities for investors looking for long-term investment.

Tips for Real Estate Investors in the Middle East

Carefully study the local market of each city and understand the economic and political factors affecting it.

Diversify investments between residential, commercial and tourist properties to achieve diversified returns.

Benefit from new laws and government initiatives supporting real estate investment.